Car accidents in North Carolina are more than just a legal hassle—they’re a financial risk, especially given the state’s contributory negligence rule, which bars accident victims from receiving any compensation if they are found even 1% at fault. This makes filing a claim in cities like Charlotte, Raleigh, Greensboro, Durham, and Winston-Salem even more complicated.

According to the North Carolina Department of Transportation (NCDOT), there were 276,026 crashes reported in 2022, with 1,784 fatalities and 114,722 injuries across the state. The highest accident rates were found in Charlotte and Raleigh, where congested highways like I-85, I-40, and I-77 see frequent collisions.

Given these risks, understanding North Carolina’s at-fault system, minimum insurance requirements, and contributory negligence law is crucial. This is where an AI lawyer can help, offering real-time legal insights, fault analysis, and assistance in filing claims accurately to avoid denial due to North Carolina’s strict fault laws.

Why Consider an AI Lawyer in North Carolina?

1. Contributory Negligence: The 1% Rule That Can Cost You Everything

North Carolina is one of the few states that follow a pure contributory negligence system, meaning if you’re even slightly at fault for an accident, you may receive nothing in compensation.

An AI lawyer can analyze your accident details—police reports, insurance statements, witness accounts—and compare them to precedents in North Carolina courts to estimate how fault will be determined. If there is any indication of shared liability, AI can recommend the best course of action to challenge it and maximize your claim.

2. At-Fault System and Insurance Minimums

Unlike No-Fault states like Michigan and Florida, North Carolina follows an at-fault system, meaning the driver responsible for the accident (or their insurance) must pay damages. The state’s minimum insurance requirements are:

• $30,000 per person for bodily injury

• $60,000 per accident for bodily injury

• $25,000 for property damage

Many drivers carry only the minimum coverage, which may be insufficient for serious accidents. An AI lawyer instantly determines if your damages exceed the at-fault driver’s insurance limits and whether Uninsured/Underinsured Motorist (UM/UIM) coverage can help.

3. Navigating Insurance Claims and Bad Faith Tactics

North Carolina insurance companies often use delay tactics or denial strategies, especially in contributory negligence cases. If your claim is denied, insurers may argue:

• You admitted partial fault in statements.

• You delayed medical treatment, meaning injuries were not serious.

• There were discrepancies in your statements vs. witness accounts.

An AI lawyer helps draft precise demand letters, analyze insurance adjuster tactics, and ensure you don’t unknowingly jeopardize your case.

4. Statute of Limitations: How Long Do You Have to File a Claim?

North Carolina has strict deadlines for filing claims:

• Personal injury: 3 years from the accident date (N.C. Gen. Stat. § 1-52)

• Property damage: 3 years

• Wrongful death: 2 years

AI legal tools help track filing deadlines, notify you before they expire, and generate necessary legal paperwork automatically.

5. What If the At-Fault Driver Is Uninsured?

North Carolina requires all insurers to offer Uninsured Motorist (UM) coverage, but not all drivers opt for it. If the at-fault driver has no insurance, you may need to file a UM claim. AI legal tools instantly determine if this is an option and help you submit a claim without delays.

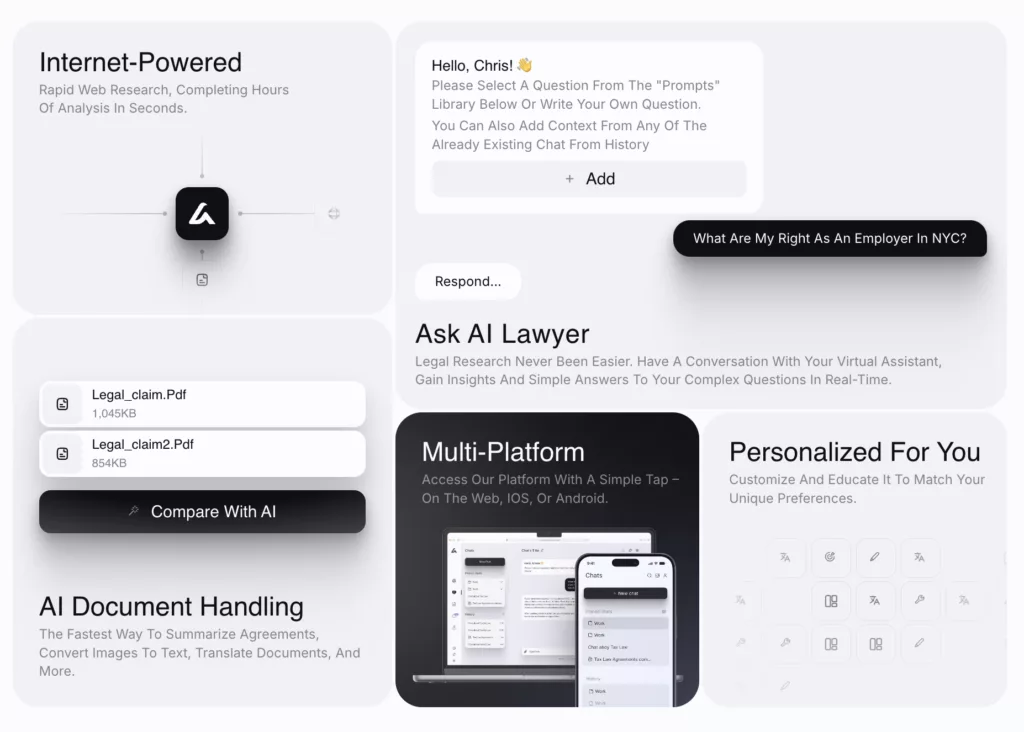

Example of an AI Lawyer Interface: How It Works

Imagine a seamless, user-friendly dashboard designed to guide you through every step of your car accident claim in North Carolina. With clear prompts and real-time legal insights, the system ensures you’re fully prepared to handle the complexities of contributory negligence laws and insurance regulations.

Step 1: Input Key Accident Details

Upon logging into the AI Lawyer platform, the system prompts you to provide essential information about your accident. This includes:

• Accident Location: Specify where the accident occurred, such as “I-77 near Charlotte” or a specific intersection.

• Date and Time: When the accident took place, helping ensure all timelines for filing claims are met.

• Injury and Damage Overview: Describe injuries sustained and the extent of vehicle damage.

• Fault Disputes: Were you found partially at fault or is liability contested? This detail helps the system flag potential issues under North Carolina’s strict contributory negligence rule.

Step 2: Analyze Insurance Coverage

The AI tool cross-references your inputs with North Carolina’s insurance laws, determining:

• Whether the at-fault driver’s insurance meets minimum coverage requirements.

• If your damages exceed the at-fault driver’s policy limits and whether UM/UIM coverage applies.

• Whether your case qualifies for non-economic damages like pain and suffering, based on the serious injury threshold.

Step 3: Generate Actionable Steps

After processing your information, the system provides a customized list of next steps, including:

• Drafting a Notification Letter: A professionally written template to inform your insurer or the at-fault driver’s insurer about your claim.

• Evidence Checklist: A step-by-step guide on collecting and organizing critical documents, such as police reports, medical bills, and witness statements.

• Fault Allocation Insights: If fault is disputed, the AI flags potential risks and provides strategies to reduce liability.

Step 4: Ongoing Support and Tracking

Once your claim is initiated, the AI lawyer continues to assist by:

• Tracking filing deadlines, ensuring you don’t miss the three-year statute of limitations for personal injury claims.

• Analyzing responses from insurance adjusters and suggesting appropriate counterarguments if they attempt to devalue your claim.

• Providing real-time updates about your case status, so you’re always informed.

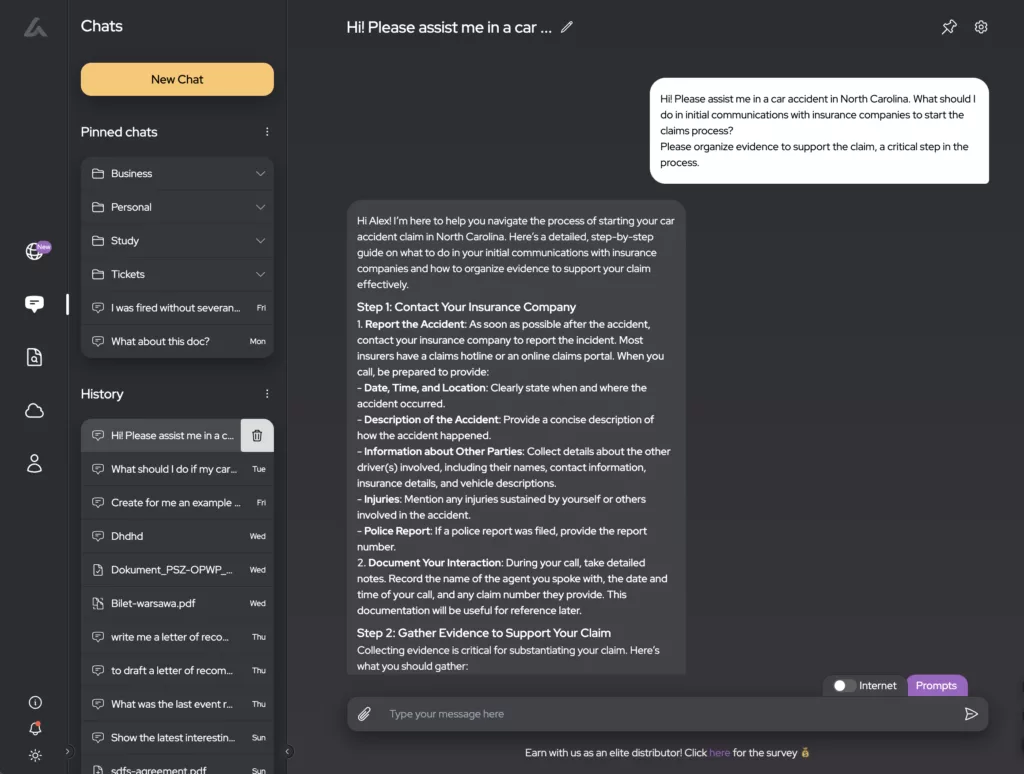

AI Lawyer in Action: Example Request

Here’s how the product might respond to a common user query:

User Request:

“Hi! Please assist me in a car accident in North Carolina. What should I do in initial communications with insurance companies to start the claims process? Please organize evidence to support the claim, a critical step in the process.”

AI Lawyer Response:

1. Report the Accident:

• Contact your insurance company as soon as possible. Provide essential details such as the date, time, and location of the accident, a description of how it occurred, and injuries sustained.

• Include the police report number, if applicable.

2. Document the Scene:

• Take photos of the accident site, vehicle damage, and visible injuries.

• Collect contact information from witnesses for future corroboration.

3. Organize Evidence:

• Upload all medical records, repair bills, and correspondence with the insurer to the platform. The AI will verify that no critical documents are missing.

4. Insurance Interactions:

• Avoid giving detailed statements to insurance adjusters without consulting the AI lawyer. Use the platform’s suggested scripts to ensure you don’t inadvertently admit partial fault.

5. Next Steps:

• Based on your case, the AI will recommend whether to negotiate directly with the insurer or prepare for potential litigation.

How North Carolina Compares to Other States

• Unlike Georgia and Illinois, where you can be partially at fault and still recover damages, North Carolina bars compensation if you’re even 1% at fault.

• Unlike Pennsylvania or Michigan, North Carolina does not have a No-Fault system, meaning all claims must be made against the at-fault driver.

• Florida and New York allow lawsuits under certain thresholds, while North Carolina’s contributory negligence rule makes litigation tougher for victims.

Want to compare how North Carolina stacks up? Read our other guides on Georgia and Michigan.

Frequently Asked Questions (FAQ)

Q1: How Does North Carolina’s Contributory Negligence Rule Work?

A: If you are found even 1% at fault, you cannot receive any compensation from the other driver’s insurance. This makes legal representation crucial to avoid being unfairly assigned blame.

Q2: Do I Need a Lawyer If I Was in a Minor Car Accident in North Carolina?

A: Even in minor accidents, insurance companies may deny claims based on contributory negligence. An AI lawyer helps ensure your statements and documentation do not create liability issues.

Q3: How Long Do I Have to File a Car Accident Claim in North Carolina?

A:

• Personal injury: 3 years from accident date

• Property damage: 3 years

• Wrongful death: 2 years

Filing late automatically disqualifies your claim.

Q4: What If the At-Fault Driver Doesn’t Have Enough Insurance?

A: If your damages exceed the at-fault driver’s coverage, your Underinsured Motorist (UIM) coverage can help cover additional costs.

Q5: What Are the Most Dangerous Roads for Accidents in North Carolina?

A: According to the NCDOT crash report, the roads with the highest accident rates are:

• I-85 (Charlotte to Durham)

• I-40 (Greensboro to Raleigh)

• I-77 (Charlotte area)

Conclusion

Navigating car accident claims in North Carolina is difficult due to strict contributory negligence laws and insurance company pushback. AI lawyers simplify the process by analyzing fault percentages, tracking deadlines, and generating legal paperwork to strengthen your claim.

If you’ve been in a car accident in North Carolina, don’t risk losing compensation due to insurance tactics or contributory negligence laws—let AI legal tools guide you to a fair outcome.