ar accidents in Michigan are not just common—they’re a daily reality, especially in high-traffic urban areas like Detroit, Grand Rapids, Warren, Sterling Heights, and Ann Arbor. According to the Michigan State Police Traffic Crash Statistics, there were 293,341 total crashes reported in Michigan in 2022, with 1,123 fatalities and 51,066 injuries statewide. Detroit alone accounted for over 20% of all crashes in the state, making it one of the most accident-prone cities in the Midwest.

With Michigan’s No-Fault insurance system, filing a claim can be more complicated than in other states. The 2019 No-Fault reform has added new challenges, from choosing the right PIP coverage to understanding whether you qualify for pain and suffering damages. This is where an AI lawyer becomes invaluable—helping drivers instantly analyze their insurance coverage, fault allocation, and compensation options after an accident.

Why Consider an AI Lawyer in Michigan?

1. Understanding Michigan’s No-Fault Insurance System

Unlike at-fault states like Georgia and Illinois, Michigan operates under a No-Fault insurance system, meaning your own insurance company pays for medical bills and lost wages, regardless of who caused the accident. However, following reforms in 2019, drivers can now choose from multiple PIP coverage levels, making the claims process more complex than ever.

An AI lawyer quickly determines which level of PIP coverage you selected and helps estimate how much compensation you can claim from your insurer. It also assesses whether you qualify to sue for additional damages under Michigan’s serious injury threshold.

2. Medical Bills and PIP Coverage: How Much Can You Claim?

Michigan drivers can now customize their PIP coverage, choosing from:

• Unlimited coverage (traditional No-Fault model)

• $500,000, $250,000, or $50,000 PIP limits

• Opt-out option (only available if you have separate health insurance)

If you’re injured in an accident, your AI lawyer will calculate which expenses fall under PIP and whether you need to file a third-party claim against an at-fault driver to cover additional medical costs or lost wages.

3. When Can You Sue in Michigan?

Michigan’s No-Fault law typically limits lawsuits, but you can still sue for:

• Serious impairment of a bodily function

• Permanent disfigurement

• Pain and suffering (if injuries meet the “serious injury threshold”)

AI-driven tools compare your medical records against legal precedents, helping determine whether your injuries qualify for pain and suffering damages.

4. Calculating Fault Under Michigan’s Comparative Negligence Rule

Michigan follows a modified comparative negligence system. If you’re more than 50% at fault, you cannot recover non-economic damages (such as pain and suffering). However, you may still recover economic damages.

Your AI lawyer assesses police reports, witness statements, and crash details, helping estimate how insurers and courts will allocate fault percentages. This analysis helps strengthen your claim and negotiate fair settlements.

5. Filing Deadlines & Paperwork Handling

Michigan has strict timelines for filing claims:

• One year for No-Fault (PIP) benefits

• Three years for filing a lawsuit against an at-fault driver

An AI lawyer ensures you meet all deadlines, helping track required documentation and notify insurers before claim windows close.

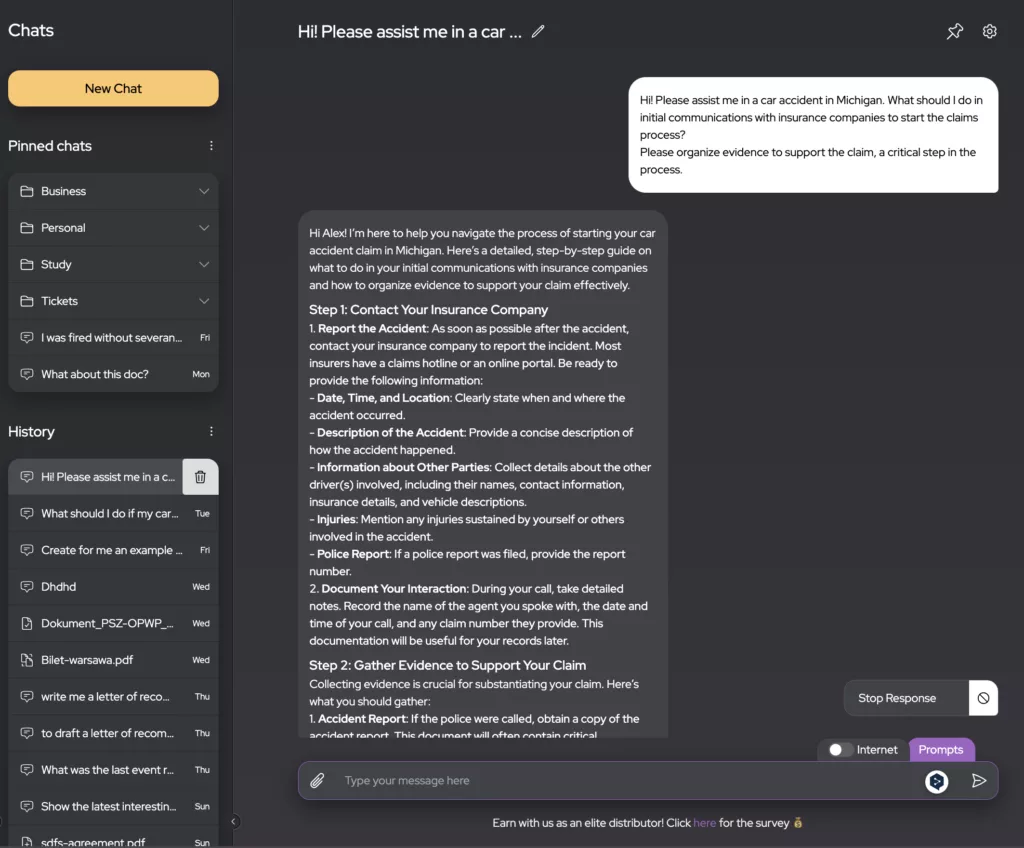

Example of an AI Lawyer Interface

Imagine a digital dashboard where you input:

• Accident details (location, date, road conditions)

• Insurance type (unlimited PIP, limited PIP, or opt-out)

• Injury severity

Within seconds, the AI system provides a compensation estimate, confirms whether you qualify to sue, and outlines next legal steps tailored to Michigan’s auto laws.

How Michigan Compares to Other States

• Unlike New York and Florida, Michigan allows drivers to choose their level of PIP coverage instead of requiring unlimited No-Fault benefits.

• Unlike Georgia or Illinois, Michigan does not follow a traditional at-fault system—except when suing for serious injuries.

• Pennsylvania has a “choice No-Fault” system, while Michigan has mandatory No-Fault coverage with different limit options.

Want to explore how other states handle accident claims? Read our guides on New Jersey and Illinois.

Frequently Asked Questions (FAQ)

Q1: How Does Michigan’s 2019 No-Fault Reform Affect My Claim?

A: In 2019, Michigan allowed drivers to choose their level of PIP coverage, reducing insurance costs but increasing legal complexity. Now, depending on your selected PIP limit, your insurance may cover fewer medical bills, requiring additional claims against at-fault drivers.

Q2: Do I Still Need a Lawyer If Michigan Has No-Fault Insurance?

A: Yes. Even in No-Fault states, determining whether you qualify for additional lawsuits, how fault is assigned, and what medical expenses are covered requires legal expertise. AI lawyers help clarify whether your injuries meet Michigan’s “serious injury” standard for lawsuits.

Q3: What If an Uninsured Driver Hits Me in Michigan?

A: Michigan requires insurers to offer Uninsured Motorist (UM) and Underinsured Motorist (UIM) coverage, but it’s optional. If the at-fault driver has no insurance, your UM/UIM policy may cover damages, or you may have to seek Michigan’s Assigned Claims Plan for compensation.

Q4: Can I Sue for Pain and Suffering After a Car Accident in Michigan?

A: Only if you meet Michigan’s serious injury threshold, meaning:

• A significant impairment of an important bodily function

• Permanent disfigurement

• Death (wrongful death claims by family members)

Q5: How Long Do I Have to File a Car Accident Claim in Michigan?

A: The deadline depends on the type of claim:

• PIP (No-Fault) Claims – Must be filed within 1 year of the accident.

• Third-Party Lawsuits – Must be filed within 3 years against an at-fault driver.

An AI lawyer ensures you meet all deadlines and submits claims on time.

Conclusion

Michigan’s No-Fault system, combined with its 2019 reform changes, makes navigating accident claims difficult—especially for those unfamiliar with PIP limitations, comparative negligence, and legal thresholds. Whether you’re filing for medical compensation, lost wages, or considering a lawsuit, an AI lawyer simplifies the process by analyzing insurance coverage, organizing evidence, and ensuring deadlines aren’t missed.

If you’re struggling with a car accident claim in Michigan, don’t leave your compensation to chance—leverage AI technology to navigate the system efficiently and maximize your settlement.